Altrix is launching a PAYE payroll service….. AltrixPay

Following feedback directly from members and seeing the increasing number of umbrella companies encountering issues which impact members getting paid, Altrix is pleased to launch its own PAYE payroll service – AltrixPay.

AltrixPay will pay weekly on a Tuesday and is available to all new and existing members. If you choose AltrixPay, Altrix will be responsible for paying you directly net of tax, national insurance and any other statutory deductions. This means you do not need to deal with anyone else regarding your shifts or pay with Altrix.

By joining AltrixPay there is no administration fee and you will be eligible to be enrolled in the Altrix Pension Scheme three months after working your first shift.

Existing members can easily switch to AltrixPay by going to the Payroll Setup tab in the Profile section of the Altrix app and selecting the PAYE option.

New members will be offered the PAYE option when they reach the Payroll Setup during their registration.

More information can be found in our Frequently Asked Questions section below.

Frequently Asked Questions

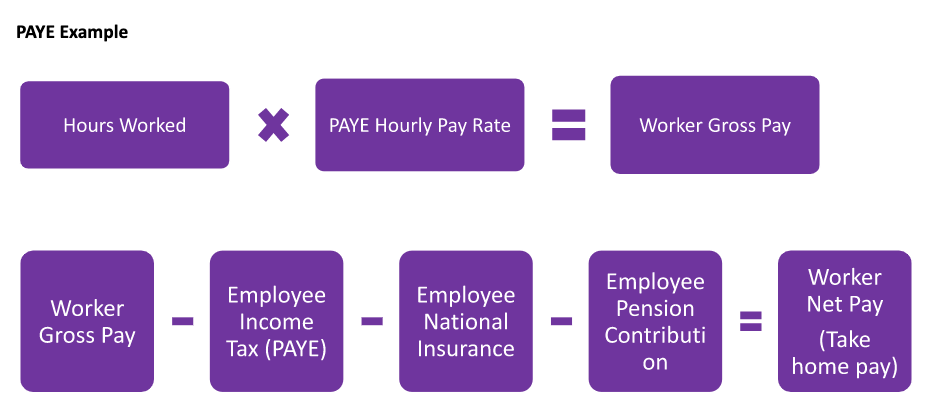

PAYE, which stands for ‘pay as you earn’, is a method through which most employees in the UK pay income tax.

Before any money is transferred to your account, Altrix will deduct income tax, which is calculated based on your tax code. The main element that affects the amount of tax you pay is your annual earnings, but there are certain allowances and deductions that can also be taken into account. This money is then paid over to HMRC. Depending on your circumstances, National Insurance contributions and student loan repayments may also be deducted from your pay using PAYE.

Altrix will be responsible for paying you directly net of tax, national insurance and any other statutory deductions. This means you do not need to deal with anyone else regarding your shifts or pay with Altrix.

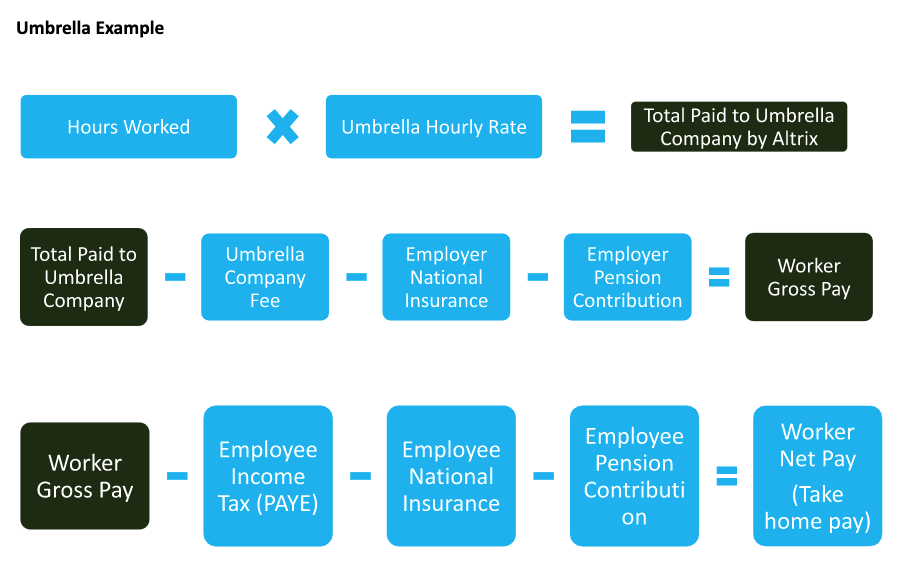

Umbrella companies charge you a fee for running your payroll. As umbrella companies are unregulated, we recommend you read guidance relating to umbrella companies provided by the UK Government here.

You can register for PAYE with Altrix straightaway and start being paid directly by Altrix without informing your umbrella company. However, to ensure you are taxed correctly by HMRC you may wish to resign from your umbrella company and get a P45. We recommend members ensure the umbrella company pays all the amounts owed and any retentions for holiday pay or contingencies which may have been held back during the period of the contract.

The hourly rate paid to Umbrella Companies includes elements of employment costs such as employer’s National Insurance and umbrella company margin. When you are paid directly by Altrix these costs are either not relevant or not included in your hourly rate as Altrix is responsible for them. This means you will know exactly how much your gross pay will be prior to income tax, employee National Insurance and any pension contribution or loan repayment deductions being made.

The table below shows the key deductions for each payment method:

- Altrix will be responsible for Tax and NI Deductions at source

- You save on Umbrella company admin costs

- You will be eligible to be enrolled in the Altrix pension scheme

- Cuts out third party in getting paid

Altrix will pay weekly, every Tuesday. This means that all timesheets submitted by Monday at 10am and subsequently authorised will be processed for payment into your account on a Tuesday.

You will accrue holiday from each shift worked and this will be paid at the end of the assignment at the same time you are paid for the shift.Holiday will accrue based on an annual entitlement of 5.6 weeks.

Details of how to register and access payslips can be found here. A video showing how to create your account to view your payslips is

Payslips will be available every Tuesday afternoon.

Download the Altrix app and when registering to join us, select the PAYE option in the Payroll Setup tab.

In the Altrix app, go to the Payroll Setup tab in the Profile section and select the PAYE option.

Yes, Altrix offer the NEST Pension Scheme and eligible members will be auto-enrolled into the scheme three months after working their first shift. You don’t need to do anything as you will be automatically enrolled and we will write to you with more details at the time. More information about Nest can be found here.

A pension is a way of saving regular amounts of money throughout your life. All workers are encouraged to make regular contributions so that they do not have to rely on the state when they reach the State Pension age. If you are a member of a workplace pension scheme, contributions towards your pension are deducted from your pay, along with both tax and National Insurance. This means that, once these deductions have been made, the figure in your final payslip will be slightly lower.

Throughout your working life, you may acquire a number of pension funds, depending on how many different agencies or direct employers you work through. Should you switch schemes, don’t worry; any money amassed under a previous pension scheme will remain yours and will be made available once you retire. Alternatively, you can continue paying into a previous pension scheme, transfer your pension to your current scheme or begin drawing your pension (providing you are eligible to do so).

If you are a PAYE worker of Altrix, you are not an employee of an NHS Trust and are not, therefore, eligible to join the NHS pension scheme. You may be enrolled in our Automatic Enrolment pension scheme, providing you meet the eligibility criteria. If you are already a member of the NHS Pension Scheme, your earnings with Altrix will not count towards your NHS pensionable pay.

Altrix operates the NEST pension scheme. NEST is a workplace pension scheme set up by the government. Your employee contribution is 5% of your qualifying earnings. Most people will only pay around 4% of their take-home pay as they’ll get tax relief from the government every time they contribute. Altrix will also contribute 3% of your qualifying earnings to bring the total up to 8%. More information about NEST can be found here.

You cannot opt out of the automatic enrolment process, as your employer is obliged to enrol you into a pension scheme. However, you can opt out of membership of the scheme once you have been enrolled.

You should think carefully before opting out of any pension scheme. There are lots of benefits to having a pension, including tax relief. If you opt out within one month of the start of the opt-out period, you should be treated as if you had not been a member of the scheme and a refund of any contributions deducted from qualifying earnings should be given. This can be done by completing the opt-out notice form and sending it to your employer or pension provider.

However, if you opt-out outside of this period, your pension scheme membership will be stopped. You may be able to receive a refund of contributions but this will depend on the pension scheme rules.

You can ask to opt back into a pension scheme at any time if you change your mind.

Please note that your employer is required to re-enrol you into a pension scheme every 3 years, regardless of whether you have already chosen to opt out. You will be notified in advance of this happening and if you still wish to opt-out you will be given the opportunity to do so.